Education

B.A. in Political Science from the University of Texas at Austin; Doctor of Medicine from Texas Tech; Internal Medicine Internship and Residency at the Baylor School of Medicine in Houston, TX; Pulmonary Fellowship at the University of California San Francisco

Contact

Philip Sanger, MD

As an active investor and the founder of multiple ventures, including a publicly traded Medicare-Advantage Health Plan, Dr. Sanger understands what it takes to build a successful healthcare company. After working for more than 25 years as a pulmonary and critical care specialist, he also understands firsthand the complexities and challenges of the healthcare system. He now leverages this knowledge to provide both capital and collaboration as a Managing Partner of TEXO Ventures.

Dr. Sanger has dedicated his career to patients and the entrepreneurial endeavors that would better serve them. In the early 1980s, he served as the Chief of Pulmonary Medicine at the Texas Tech School of Medicine in Lubbock, Texas. By 1990, he had founded and sold a home health durable medical equipment company, launched and grew a profitable Preferred Provider Organization (PPO) to over 50K subscribers, and built a 54K square-foot multi-specialty surgical center, imaging facility, and laboratory that was acquired by a publically traded company. In 1996, he founded Intercede Health and developed it from a 3-person hospitalist company into a leader in comprehensive medical management impacting care for over 1 million patients. He went on to help launch and serve on the Board of HealthSpring through a successful IPO in 2006.

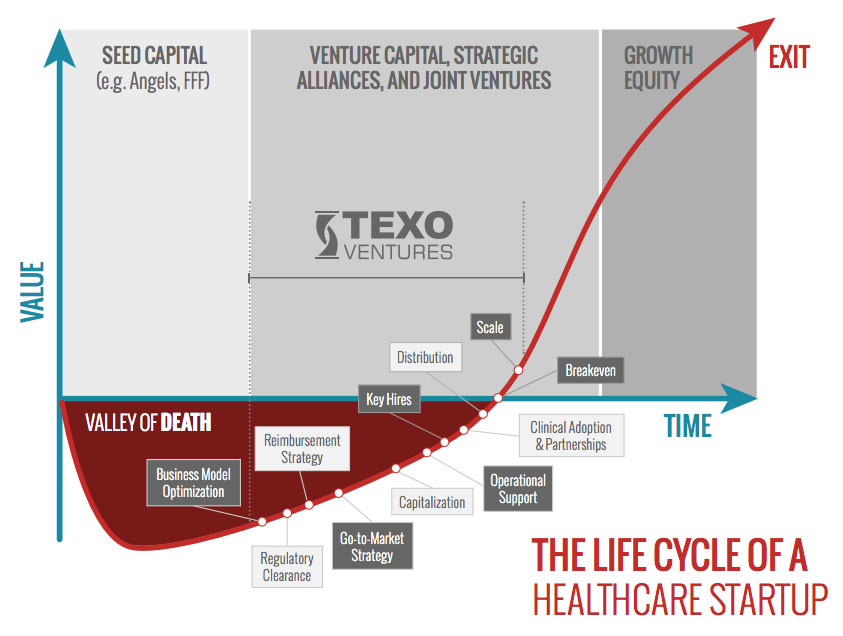

While Dr. Sanger’s vision for hospitalist medicine and medical management strategies can be found in national publications like Managed Healthcare Executive, Health Insurance Underwriters, The Hospitalist Magazine, and Disease Management Advisor, he is most proud of his work with entrepreneurs. Many healthcare startups fail because they don’t understand the regulatory process or they lack the network of industry professionals who will not only validate their product or service, but also drive market traction.

Dr. Sanger currently serves on the Board of Intercede Health, Televero Health and Wenzel Spine. He is also an advisor to Santé Ventures.